Research Paper By Sherry Maklary

Research Paper By Sherry Maklary

(Health & Fitness Coach, UNITED STATES)

Executive Summary

JXB (pseudonym for anonymity) is a Fortune 500 healthcare company that is currently undergoing multiple transformational initiatives across the finance organization. These transformational initiatives include the areas of people, process, technology, and organizational initiatives, simultaneously. The purpose of this simultaneous initiative is to standardize work, simplify processes, reduce duplicative effort, gain labor arbitrage, perform jobs more efficiently/effectively, and reduce risk. The overall benefits are to save costs, become more competitive, and allow JXB to reinvest the savings back into the business to contribute to more life-saving initiatives for the customers, patients, doctors, and hospitals served.

The change impacts associated with these initiatives are massive and finance employees essentially must learn an entirely new way of working. Before these initiatives, each of the JXB businesses had finance generalists who performed an array of functions. In this new model, there are now finance, accounting, and taxation specialists who are doing very different work, with new processes, and technologies. These deployments are occurring in phases, globally, across JXB. For employees who were included in the early phases of the deployments, metrics indicated substantial resistance to these changes, increased attrition, reduced engagement, declining motivation, and shadow organizations forming across the finance population. Employees were being trained in the new structure and ways of working, but many were falling back into old habits and doing work as it had always been done.

To address these issues, a recommendation to leadership was made to design, develop, and implement a formal coaching program to be deployed across the finance organization to help facilitate the change adoption. The blueprint for this program will be explained in detail in the upcoming paper including highlights of the coaching model, desired coaching competencies, program features, diversity components, and relationship mitigation, to name a few. According to Rock and Donde (2008), coaches can facilitate change by shifting the culture through conversation, lift performance, and drive leadership with innovative coaching solutions. The program intends to aid in the adoption of the change, increase retention, improve engagement, and facilitate the new ways of working with finance employees through change coaching.

Section 1:

Identification and Need for Formal Coaching Program at JXB

JXB is a Fortune 500 healthcare company that is currently undergoing multiple transformational initiatives across the finance organization. Companies included in this Fortune list are based on the highest ranking in revenues, market share, profit, and other similar indicators (Cummings & Worley, 1997). These transformational initiatives include the areas of people, process, technology, and organizational initiatives, simultaneously. This means that six thousand global finance employees must learn new standardized processes, including business partner interactions and hand-offs. They must execute these processes using new modern technologies, while in newly defined job roles constituting a new remit of responsibilities. The finance organization has been redesigned so the reporting lines have been moved into a three-tiered structure, consisting of shared service centers (SSCs), centers of excellence (CoEs), and a Corporate tier. Each tier can function either on a global basis (service the global organization), regional basis (serve solely the region in which it resides), or local (country-specific). Thus, this three-tiered model is also called the nine-box model, given three tiers times three service options, global, regional, local, equals nine.

The overall responsibilities of the shared service centers are to perform routine transactional finance functions such as journal entries. The CoEs are performing more complex analytic work and financial reporting. The Corporate tier handles corporate functions such as treasury, compliance, and taxation. The purpose of the people, process, technology, and organizational changes made was to standardize work, simplify processes, reduce duplicative effort, gain labor arbitrage, perform work more efficiently/effectively, and reduce risk. The overall goals were to save costs, become more competitive, and allow JXB to reinvest the savings back into the business to contribute to more life-saving initiatives for the customers, patients, doctors, and hospitals served.

The change of these initiatives is massive and finance employees essentially must learn entirely new ways of working. Before these initiatives, each of the JXB businesses had finance generalists who performed an array of functions. In this new model, there are finance, accounting, and taxation specialists who are doing very different work, with new processes and technologies. For those employees involved in the early deployments, metrics revealed their substantial resistance to these changes, increased attrition, reduced engagement, declining motivation, and shadow organizations forming across finance. Employees were being training in the new structure and ways of working, but many are falling back into old habits and doing work as it had always been done.

According to Rock and Donde (2008), coaches can facilitate change by shifting the culture through conversation, lift performance, and drive leadership with innovative coaching solutions. As such, a recommendation to leadership was made to design, develop, and implement a formal coaching program to be deployed across the finance organization to help facilitate the change adoption. The blueprint for this program will be explained in detail in the upcoming paper to share the coaching model, desired coaching competencies, program features, diversity components, and relationship mitigation, to name a few. The intent was to aid in the adoption of the change and facilitate the new ways of working across finance through a change coaching program. There was substantial concern across the organization, that if an immediate intervention was not implemented, the negative outcomes would continue to proliferate.

Section 2:

Description of the Recommended Coaching Program

The Coaching Model

While coaching models are highly diverse there is an underpinning that they facilitate purposeful organizational change(Passmore, Peterson, & Freire, 2012). Coaching models have been used to facilitate organizational cultural change (Anderson, 2008) and to reduce resistance to change (Passmore, 2007). The type of coaching model recommended needs to be all-inclusive to address an array of challenges being experienced by the finance employees. Since there did not seem to be a single coaching model that was relevant to the change, a hybrid approach using specific models at precise time periods in the deployments were most relevant. According to Hackman and Wageman (2005), using a coaching intervention at various times in the life cycle can be most effective. At the pre-deployment and initial stages of deployment, motivational coaching is needed to inspire groups at this performance period and get them engaged in the change (Hackman & Wageman, 2005). By identifying the “why” of the change and touching on the emotional reasons of importance proves helpful to improve the embracing of the change and assists the group members in uniting and moving forward on a unified path (Whiteman, 2013). During the mid-points, consultative coaching would be most appropriate, followed at the end of the deployment period by educational consulting for the group (Hackman & Wageman, 2005). Educational consulting at the end will help ensure the new ways of working are understood, knowledge transfer has occurred, and shadow organizations are not formed. Behavior changes around the new technologies and processes and reinforcement for the behavior changes surrounding them is critical to sustaining the change at all levels of the finance organization.

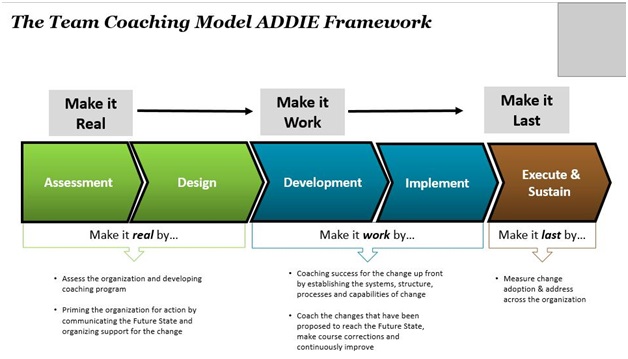

The coaching model can be applied using the assess, design, develop, implement, evaluate (ADDIE) framework, often used in instructional system design (Seels & Glasgow, 1998) (reference Appendix A). This will be the global framework that is executed regionally to ensure consistency of the team coaching model, using the same tools and techniques. Using this framework will allow for a standard needs analysis assessment, usage of external benchmarking, internal feedback, guidelines, systematic implementation, and consistent evaluation techniques for measurement (Seels & Glasgow, 1998). The ADDIE framework will reduce duplicative effort and ensure there is an end-to-end process for the coaching model to be applied according to the results of the needs assessment, while designed, developed, implemented, and evaluated pragmatically.

The Coaching Competencies Critical for Coaches in the Program

There are numerous coaching competencies that coaches are expected to master based on the type of coaching provided. In the terms of motivation, the key competencies would be the perception of the uniqueness of the business situations, group/team behavior, team leadership in a transitional organizational setting, setting priorities, stakeholder management, change through imaging, and know-how in change management (Ahern, 2003). The overall goal would be to build a shared commitment to the group’s work (Hackman & Wageman, 2005). Consultative coaching would involve the ability to minimize mindless execution of work and to help groups embrace the new ways of working with innovation and /or invention (Hackman & Wageman, 2005). The educational aspects of the coaching would involve competencies to foster knowledge and skills of group members such as job design, working life balance, and questioning (Ahern, 2003). These competencies would foster the behaviors needed by the coaches who will serve as the agents of change championing, coaching, and influencing locally to help facilitate local and regional adoption in the spheres they influence.

The Exemplary Features of this Program

Multiple features are exemplary for this program and that differentiate it from other programs. As mentioned, it is a hybrid approach using a team coaching model that will assist the finance groups to operate in their new social system together, transacting collectively and responsible for the work (Hackman & Wageman, 2005). The model will be further delineated based on the deployment phases to resulting in coaching specifically related to motivational aspects, consultative, and/or educational as needed to assist the teams in embracing new ways of working and reducing change resistance (Hackman & Wageman, 2005). They are key competencies identified for the internal coaches which are critical to foster the success of the coaches and those being coached (Ahern, 2003). There is also a closely aligned communication plan, stakeholder analysis, consistent messaging, and other tactical change management focused components to help ensure success and sustainability (Standard for Change Management, 2014). The final feature to differentiate this program is the recommendations are based on evidence-based data from peer-reviewed studies and publications, adding scholarly research and applying it practically to this organizational setting (Baba & HakemZadeh, 2012).

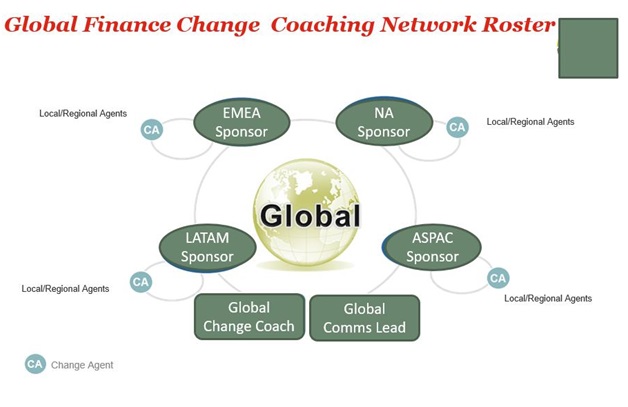

Diversity of this Program

Diversity is key in any coaching program and this one is not an exception. Although this coaching model is a team coaching model, according to Peterson (2007) coaching fundamentally occurs at the individual level. Since the JXB culture is very dominant amongst its employees, coaching must be done by an internal diverse group of employees versus external consultants (Peterson, 2007). This program must have a diversity of coaches who will be stationed across all the regions to handle the diverse nature of the global organization (reference Appendix B). This will contribute diverse perspectives, cultural awareness, insights, and resonate with the broad diverse finance population. Local coaches will be sought from within the regions because they will be most poised to understand how the change is impacting the region and local country employees. These coaches will serve as the agents of change championing, coaching, and influencing locally to help facilitate local and regional adoption in the spheres they influence. The consistent messaging will be developed globally, and the local diverse coaches will adjust it according to the local culture and needs of the finance populations they support.

Addressing Negative Coaching Relationships in the Program

According to Eby, McManus, Simon, and Russell (2000), five negative behaviors range from manipulative behavior, lack of mentor expertise, to general dysfunctionality that are common in negative mentoring/coaching experiences. In a like manner, Raggins and Cotton (1991) found that cross-gender mentoring can result in overprotection or sexual tension between the parties in the mentor relationship. These are just some of the ways negative coaching experiences have been described in the literature. It will be imperative to vet and interview the potential coaches to ensure they have the core competencies required because according to Goleman (2000) good management coaches are difficult to find and often managers lack the requisite skills. There will also be periodic measurement systems in place with check-list formats to allow participants to monitor their coaching experiences (Eby, McManus, Simon, & Russell, 2000). While this will not completely eradicate negative experiences, it will identify them earlier, allow for adjustments, with the overall intent to reduce them.

Summary/Conclusions

JXB is currently undergoing multiple transformational initiatives across the finance organization. These transformational initiatives include the areas of people, process, technology, and organizational initiatives, simultaneously. Early metrics indicated there was low adoption of the changes resulting in substantial resistance to these changes, increased attrition, reduced engagement, declining motivation, and shadow organizations forming across the finance population. Employees were being trained in the new structure and ways of working, but many were falling back into old habits and doing work as it had always been done.

Leadership was looking for a way to address these issues rapidly because these initiatives were going to be phased over a span of five years, so early intervention to minimize organizational impacts was key. According to Rock and Donde (2008), coaches can facilitate change by shifting the culture through conversation, lift performance, and drive leadership with innovative coaching solutions. As such, a recommendation to leadership was made to design, develop, and implement a formal coaching program to be deployed across the finance organization to help facilitate the change adoption.

The program was based on team coaching and adjusted accordingly for the project phases from motivational, consultative, and educational. The framework for end-to-end consistency was the ADDIE model to ensure there was an exemplary global framework with regional execution. The core coaching competencies were identified, and internal coaching candidates will be sought to execute the model. Key elements of the program include diversity in the coaching population and local and regional presence where possible. Periodic metrics will begather to measure change adoption, understanding, and to identify issues such as negative coaching experiences so early intervention is possible. Without an innovative, effective, and efficient coaching program to address the issues for the finance employees undergoing the transition, there is a risk that JXB may not achieve the full benefit of the initiatives. With the recommended coaching program in place, coaches will provide empowerment, guided discovery, and motivational focus on the changes and new ways of working at JXB for longer-term change adoption, continuous learning, and sustainability.

References

Ahern, G. (2003). Designing and implementing coaching/mentoring competencies: a case study. Counseling Psychology Quarterly, 16(4), 373-383.

Anderson, M.C., Anderson, D.L., and Mayo, W.D. (2008). Team coaching helps a leadership team drive cultural change at Caterpillar. Global Business and Organizational Excellence, 27(4), 40– 50.

Brighton, D. (2014). The standard for Change Management. Winter Springs, FL: The Association of Change Management Professionals.

Baba, V. V., & HakemZadeh, F. (2012). Toward a theory of evidence-based decision making. Management Decision, 50, 832-867. DOI:10.1108/00251741211227546

Cummings, T.G. & Worley, C. G. (1997). Organization development and change (6th ed). Cincinnati: South-Western College Publishing.

Eby, L.T., McManus, S.E., Simon, S.A., & Russell, J.E.A. (2000). The protégée’s perspective regarding negative mentoring experiences: The development of a taxonomy. Journal of Vocational Behavior, 57, 1-21. Doi:10.1006/jvbe.1999.1726

Goleman, D. (2000). Leadership that gets results. Harvard Business Review, March/April, 78-80.

Hackman, J., & Wageman, R. (2005). A Theory of Team Coaching. The Academy of Management Review, 30(2), 269-287. Retrieved from http://www.jstor.org.ezproxy2.library.drexel.edu/stable/20159119

Passmore, J. (2007). Addressing deficit performance through coaching – using motivational interviewing for performance improvement at work. International Coaching Psychology Review, 2(3) 265-75.

Passmore, J., Peterson, D., & Freire, T. (2012). The Wiley-Blackwell handbook of the psychology of coaching and mentoring.

Peterson, D.B. (2007). Executive coaching in a cross-cultural context. Consulting Psychology Journal: Practice and Research, 59(4), 261-271.

Raggins, B.R. & Cotton, J.L. (1991). Easier said than done: Gender differences in perceived barriers to gaining a mentor. Academy of Management Journal, 34, 939-951.

Rock, D. & Donde, R. (2008). Driving organizational change with the internal coaching program: Part one. Industrial and Commercial Training, 40(1), 10-18.

Seels, B. & Glasgow, Z. (1998). Making instructional design decisions (2nd ed). Upper Saddle River, NJ: Prentice-Hall.

Whiteman, H. (2013, Mar 11). Media spotlight: Start with Why by Simon Sinek. MortgageStrategy (Online)

Appendix A

Appendix B