energy efficient goods (90%), promote health and safety benefits (88%), support fair labor and trade practices (87%), and commit to environmentally-friendly practices (87%).(6)

Although the above-mentioned research could easily be attributed to an ideal situation that is unrealistic and thus unfulfilled, recent sales data actually confirms that conscious consumers are also willing to walk the walk. Organic food, green cleaning items, products that promote sustainability, and renewable energy have all seen a surge over the past few years.(7-10)

According to Google Trends, interest in both “DIY” and “Do It Yourself” have been rising globally since 2011 and both are projected to continue growing in interest through 2014.(11,12) America’s Public Broadcasting Station referred to the rise in sustainable industries and DIY businesses (and the jobs created as a result) as being a potential “new industrial era” for growth and prosperity in the US.(13) The “sharing economy” has emerged as a new option for conscious consumers to save and earn extra money.(14,15) The sharing economy is a collection of individuals who form relationships in order to transfer or share goods and services.(14,15) Examples of this can include trading, the buying and selling of second-hand goods, the renting of one’s personal property like a lawn mower or a hammer, sharing of one’s property for free or for a fee, and public use of a private area for everyone to share. As people become more conscious of their purchasing habits and more valuable alternatives, personal financial burdens and private debt will begin to decline. Eventually the economy at large will begin to shift toward greater financial, environmental, and social sustainability due to the choices of each conscious consumer and the networks formed to support one another.

Perceptions in Financial Professions

As mentioned earlier, the conscious consumer contributes to a sustainable economy by using their increased awareness to make wiser financial choices to save money, earn money, and support causes that are important to them. Personal financial professionals, however, view sustainability in a different light and guide clients toward sustainability through debt counseling and financial investing. Three careers in personal finance that do so are credit counselors, financial planners, and money managers. Although they each are valuable in their own right, all three of these professions deny clients the decision-making, understanding, and empowerment necessary for sustainable financial growth.

Credit counselors:

Credit counselors do not however help people prevent debt in the first place. Their job is to get people out of debt, not to prevent it. Both prevention and debt resolution are important in ensuring a debt free, sustainable financial plan, as are client-driven actions, client empowerment, and shifts in mindsets. Credit counselors solve the immediate problem instead of working with clients to understand and dismantle the root problem that is causing them to overspend. On the other side of the spectrum are investment firms. There are two other categories I’d like to explore here: financial planners and money managers.

Financial planners:

Money managers:

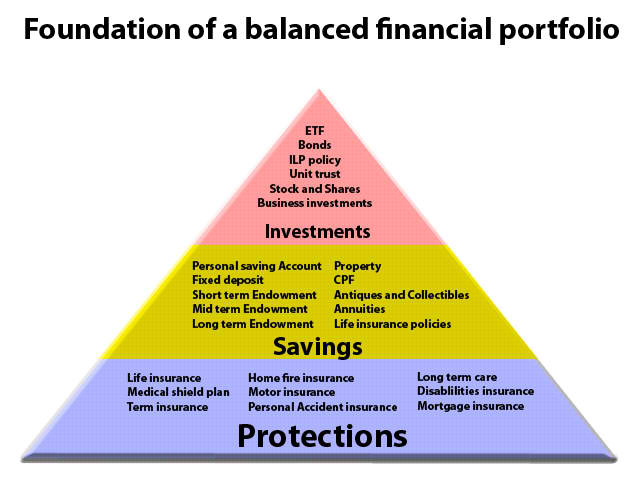

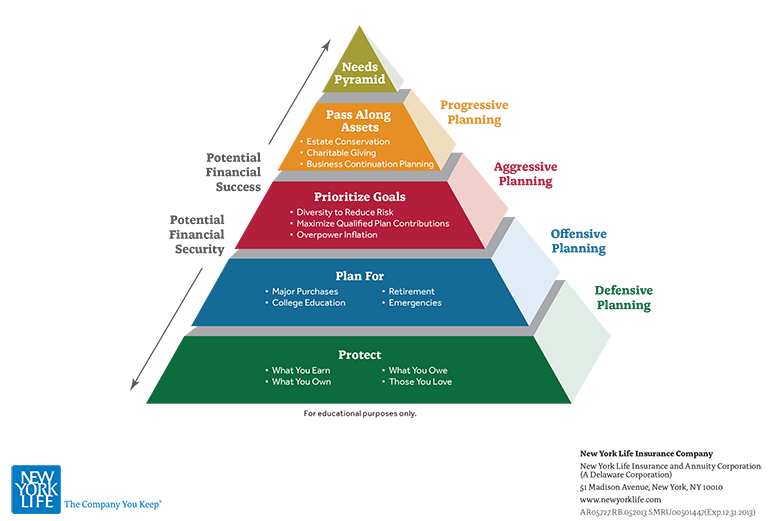

Solutions by financial planners and money managers are limited to the products available by their firms. Money managers allow for the least amount of client-driven solutions as they themselves are the managers of the client’s financial future. Financial planners and money managers consider the foundation of a sustainable financial plan to be safe investments that provide clients with a sense of security. Although they differ slightly, the following financial pyramids demonstrate this perception among these professions. Note that both of the pyramids do not include personal saving as the foundation for a financial plan.

Is Coaching the Missing Piece?

There is a great opportunity for coaches in the field of personal finance because there is nothing like it in the market. Unlike personal financial professions, coaching offers accountability, personal support, and client-driven structures and action plans.(20) Instead of formulating plans of action for clients to take based on the products that are available, coaches allow clients the space and freedom to discover what success looks like to them, what their goals are, and what it will take for them to get there. Life coaches recognize that clients are the experts of their own lives and unique situations. Action plans are personalized according to the wants and desires of the client, not the coach.(20) Solutions come in the form of brainstorming and personal research, which allows clients to think outside of the box and find fresh ideas to handle financial challenges and more creative solutions that would have otherwise gone unnoticed by these other professions. The opportunities for growth in a coaching environment are as endless as the client is creative. It is always up to the client how far down the rabbit hole he or she wishes to go. There is no pressure on clients to do anything they do not want to do, just a gentle reassurance that they have a partner in the process who will walk with them every step of the way. Coaches do not tell clients the best ways to be self-sustainable, instead coaches acknowledge that it is better for the client to explore, make mistakes, and learn in order to grow into a strong conscious consumer and creator. Especially with a topic as broad and emotional as financial stability, clients deserve to be encouraged and acknowledged as the leaders of their own destiny.

Coaching can help in many areas left untouched by many of these financial professions. Unlike investment professionals and credit counselors, coaches can help clients explore options in debt prevention, saving money, frugal living, shifting money mindsets, discovering life passions and career options, the confidence to achieve, the law of attraction, wealth building, accepting abundance, living in gratitude, sustainability and homesteading, conscious consumerism, and balancing work and life. These are all areas that contribute to the foundation of a truly sustainable financial plan. Something left unmentioned in the personal financial pyramid is that before one can invest in financial products, one should invest in themselves and their own stability.

Coaches uncover what is truly important to an individual and through those core values, unleash a client’s potential to change the way he or she interacts with money. Both conscious and disempowered consumers can use the coaching space to understand the reasons behind their actions and inspect any internal or external blocks that are preventing them from reaching their financial goals. Clients who are in debt can use coaching to begin to understand the root of their spending problems, instead of only treating the symptoms. Conscious consumers can also benefit from the coaching process by examining whatever is disconnecting their true, conscious self from their consumer self in order to become more aligned with their values when in the store or when out in their community. In the safe space provided by coaches, clients are able to explore the difference between money and wealth and determine what it is that they really want out of life, what will leave them feeling wealthy. Although money is a part of wealth, clients can begin to feel abundant without money, and through that shift, begin to allow themselves to feel grateful for the love and richness of life that surrounds them daily.