A Research Paper By Joseph Neizer, Young Couples & Couple Planning for Retirement Coach, CANADA

Understanding Financial Well-Being

This research paper will outline the principles and concepts of coaching, and how they can be leveraged to support financial literacy and improve the financial well-being of Canadian households. The paper references a 2018 survey conducted by the Financial Consumer Agency of Canada (FCAC) on the Financial Well-Being of Canadians to support its findings.

What Is Financial Well-Being?

An individual or a household’s financial well-being is defined as, the extent to which the individual or household can comfortably meet all their current financial commitments and needs while also having the financial resources to continue doing so in the future. It implies having the freedom to meet the household’s day-to-day financial obligations and cash flow needs, be able to have resources for emergency needs, and as well have a reserve for future goals such as children’s education, retirement, vacations, and another life’s important milestones and necessities.

Financial well-being is an important aspect of daily life, providing peace of mind and emotional security for Canadians. Although money is not the sole cause of anxiety and stress for individuals and families it significantly contributes makes such issues worse. This is especially seen during periods of financial and economic uncertainty such as the world is currently experiencing.

Household financial well-being has historically been an important issue for policymakers, and financial professionals(such as credit counselors, financial advisors, and educators) and continues to be an important topic today. Covid-19, the prevailing global supply chain issues, the conflict between Russia and Ukraine and the resulting rising inflation have all severely hampered the outlook of household financial well-being. These events have not only diminished a household’s real income but also significantly increased expenses, including the cost of debt, driving several families to crises point.

The Canadian Financial Consumer Agency (FCAC) survey in 2018 outlines that households with high levels of financial well-being do not experience money-related stressors as frequently, and those individuals are better equipped to handle unexpected expenses. In contrast, households with low levels of financial well-being have difficulty meeting their financial responsibilities and obligations. In essence, individuals and households with higher levels of financial well-being benefit from less financial stress, and better physical and mental health the survey finds.

The FCAC survey also demonstrated that financial well-being has a stronger relation to behaviors than economic factors. Although income is important in determining financial well-being, behavior also plays a critical role. For example, Canadians who actively contribute to their savings have higher levels of financial well-being than those with similar incomes who don’t. Additionally, Canadians who avoid borrowing to meet daily expenses have higher levels of financial well-being than those who borrow regularly, regardless of income.

The FCAC’s survey results largely compare to similar surveys conducted in Norway, Ireland, Australia, and New Zealand.

Factors Influencing Financial Household Financial Well Being

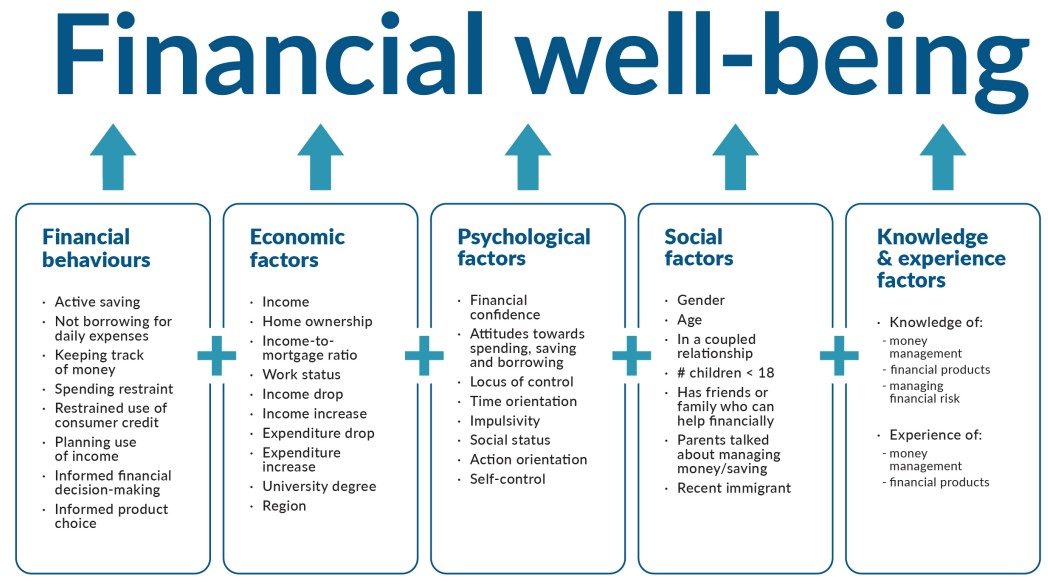

In the FCAC’s model, financial well-being is determined by 5 categories of factors:

- Financial behaviors (e.g., saving and borrowing)

- Social factors (e.g., age, employment status)

- Psychological factors (e.g., confidence, attitudes toward money)

- Economic factors (e.g., income)

- Financial knowledge and experience (e.g., experience with financial products)

A very important takeaway from the FCAC’s survey is the role financial literacy plays in all 5 categories of factors that drive Canadian households’ financial well-being, and financial behavior.

What Is Financial Literacy?

Financial literacy is defined as a specific set of skills, knowledge, and education that enables a person to make informed decisions with the financial resources that they have. Without an understanding of basic financial concepts, people are often ill-equipped to make financial management decisions. According to the Organization for Economic Cooperation and Development (OECD), financial literacy is a set of awareness, knowledge, skills, attitude, and behavior needed to make suitable financial decisions and attain individual financial well-being. The benefits of being adequately finically literate include allowing the individual family or household to make informed and better financial decisions that can lead to improved financial and economic security.

Financial Literacy, therefore, enables individuals and households to understand how money can be earned, managed, and spent. Increased financial literacy enables Canadians to make more informed financial decisions and provide a sustainable financial future for themselves and their families.

Financial literacy is a requisite for individuals and families to avoid money-related issues. According to Mind Treasures, (what is it), financial illiteracy is often a contributor to broken homes, school dropout rates, dependency on predatory lending (payday loans) and government benefits, health issues (stress, depression, anxiety), bankruptcies, foreclosures, divorces, homelessness, deficiency in economic development, and even murder-suicide in extreme cases. If youth and young people do not receive education on financial skills, they will often mirror their parent’s poor financial decision-making, continuing the cycle of financial illiteracy. Economically, a more financially literate society has the potential for less reliance on already strained and overburdened social security programs.

At the global level, the financial literacy situation varies remarkably across nations. A global survey of Standard &Poor’s Ratings Services in 2014 showed that more than 55% of residents in North America, Western Europe, and Australia could be considered financially literate. Still, the proportion of people having financial literacy in the rest of the world was less than 50 percent. Financial illiteracy is therefore an obstacle faced by both developing and developed nations. Financial literacy should be viewed as both a civil rights as well as a social justice issue, and an important contributory factor to income and wealth distribution inequalities in our society today.

Governments in many countries realized that lack of financial literacy is a huge challenge that has implications for the sustainability of a country’s economy. Financial literacy provides a process for stimulating economic development by increasing people’s financial capabilities in terms of savings, investments, and other capital formation decision-making. Moreover, the potential global economic downturn may also encourage policymakers to pay more attention to financial literacy and shift government priorities to raise awareness of the long-term financial requirements of its citizens.

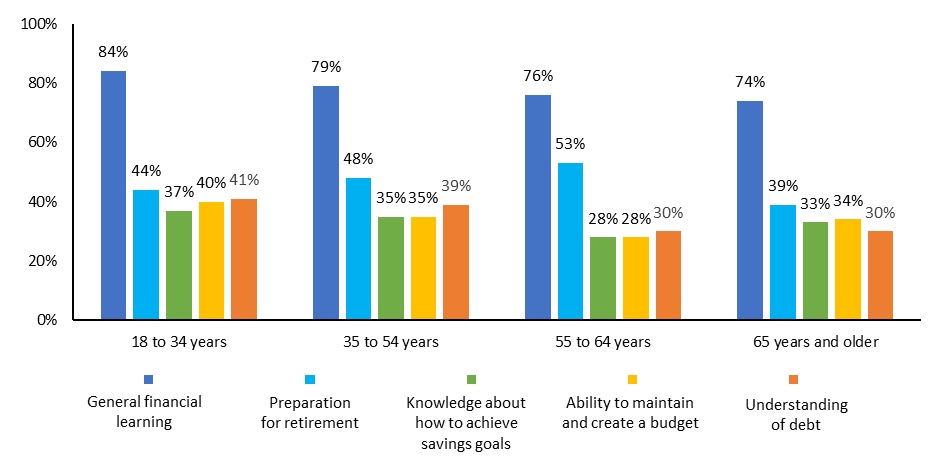

Percentage of Canadians Who Engaged in Financial Learning and Their Self-Assessed Improvements in Financial Knowledge, by Age Group

What Is a Financial Coaching?

A ‘financial coach’ is someone who helps individuals and families improve their relationship with money and stay on track to meet their financial goals. A financial coach can be distinguished from other financial professionals, such as financial planners and financial advisors, who focus on creating investment strategies and financial plans. In contrast, financial coaches take a closer look at the behavioral side of finance.

No matter how great a person’s financial plan is it is still influenced by human behavior and emotion. A financial coach can step in to prevent emotions from derailing either short-term or long-term financial success. Coaches can also assist the client to establish a positive relationship with money and determine what the client’s natural motivations are toward saving and spending.

According to a study published by Edmiston K, Fisher MG (2006) entitled, “Financial Education at the Workplace,” there is a strong relationship between financial education or financial literacy, financial awareness, and financial behavior. Financial coaching blends aspects of financial counseling, financial planning, and personal coaching to help clients establish and reach long-term financial goals through directed behavioral change.

What Does a Financial Coach Do?

Eben Burr, New York City-based president of the Behavioral Investing Institute defines a financial coach’s role as, helping a client establish processes and tools that balance their behavioral and financial needs. A financial coach helps their client create healthy financial habits and goals. These can range from day-to-day money management to planning for longer-term goals. A coach can help the individual identify the problem areas or challenges in their finances and develop strategies to overcome them. Coaching helps individuals and households develop or cultivate the essential habits required to have sound financial literacy.

Financial coaches may instruct clients “by illustrating what they may feel and actions they may want to take in different kinds of markets and then show them another way to look at a challenge from an instinctual, emotional, and historical perspective.”In this way, a financial coach can help one develop healthier financial skills and habits.”

Coaching to enhance financial literacy means providing regular coaching sessions with clients to meet specific goals and objectives mutually set by the coach and client. Coaching can be distinguished from counseling or other helping services, in that coaches are not “experts,” but instead provide encouragement and monitoring over advice and do so in a process largely driven by the client. The financial coaches’ focus is more on ongoing behavior change.

Examples of Objectives or Goals of Financial Coaching:

- Achieve client-defined goals

- Address immediate issues

- Support specific actions to meet goals

- Improve financial situations

- Change financial behaviors

- Facilitate decision-making

- Provide tools, resources, and referrals to other financial professionals

The Relationship between Financial Coaching, Financial Literacy, and Financial Wellbeing

The above studies underscore the relevance or importance of financial coaching to financial literacy and the very important and critical role financial literacy plays in understanding and appreciating the factors that support financial well-being. If an individual’s emotions are preventing them from making sound financial decisions or are causing them to make counterproductive financial decisions, they may benefit from a financial coach.

A financial coach can help someone develop a new mindset toward spending, saving, and borrowing. The coach can also help change the individual’s perspective on how much control they can have over their financial life, and this can go a long way in enhancing the individual or household’s financial well-being.

The benefit of financial coaching is a greater knowledge and understanding of financial concepts and risks, and the skills, motivation, and confidence to apply such knowledge across a range of financial contexts. In general, financial literacy is not only a survival tool but plays a crucial role in the overall financial well-being of individuals and households.

References

Financial Consumer Agency of Canada, Financial Wellbeing Survey 2018.

Financial Well-Being Survey

Kempson, E., Finney, A., & Poppe, C. (2017). Financial well-being: A conceptual model and preliminary analysis (Project note no. 3-2017).

Vlaev, I., & Elliot, A. (2013). Financial well-being components. Social Indices Research, 118, 1103–1123.

Mind Treasures: https://mindtreasures.com/financial-literacy

17 Grohmann A (2018) Financial literacy and financial behavior: evidence from the emerging Asian middle class. Pac-Basin Financ J 48:129–143

7 Calamato MP (2010) Learning financial literacy in the family. San Jose State University, California

Grohmann A, Menkhoff L (2015) School, parents, and financial literacy shape future financial behavior. DIW Econ Bull 5(30/31):407–412

The Organization for Economic Cooperation and Development (OECD) (OECD/INFE, 2013),