A Coaching Power Tool By Joseph Neizer, Young Couples & Couple Planning for Retirement Coach, CANADA

Adrift vs. Secure: Why Is It Important to Be Financially Secure?

We do not see things the way they are, we see things the way we are–Talmud

The Disclosed Personal Finance Power Tool is a coaching tool used to help reframe a client’s perspective of their current financial situation or experience. Reframing enables the client to shift from a negative or disempowering position to a positive or more empowering position. In other words, the coaching Power Tool aids and supports the client’s journey from their current position of financial uncertainty or uneasiness to a more optimistic position and financial confidence.

As a personal finance coach, I like my role and strategies as a coach to that of someone holding a flashlight and illuminating a dark path. My clients may be journeying on a poorly lit or dark financial path, however, the flashlight provides light and clarity until the client can independently move along the path holding their own light or until the path is lit enough that they no longer require the help of a flashlight.

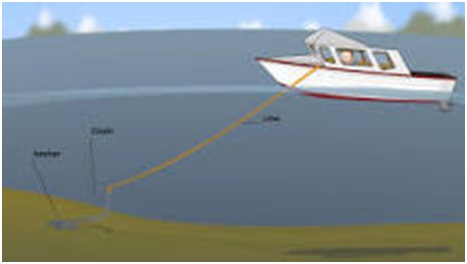

The majority of individuals and families seeking my assistance are in a position of financial distress or uncertainty. They are typically unable to find the right path forward or a path that will provide them and their families with the sound financial security they desire. Floating adrift in a sea of financial uncertainty, directionless and purposeless. The above power tool is therefore leveraged by my clients to illuminate a path of certainty and understanding. This allows them to anchor themselves in a positive financial position.

The Difference Between Adrift vs. Secure

Adrift

Sometimes I feel like a seed adrift on the wind and unable to know where I will end. – Unknown

The Free Dictionary defines adrift as “floating without being either moored or steered.”Similarly, the Cambridge Dictionary also defines a person adrift as, “If a person is adrift, they do not have a clear purpose in life or know what they want to do.”Adrift in the context of my coaching style refers to an individual without purpose or the ability to reach their target. When one is adrift, there are a variety of emotions may arise, such as a feeling of stress, depression, fear, lostness, loneliness, purposelessness, exasperation, and directionless, just to name a few. None of these emotions or feelings empower the client, promote confidence, or provide a sense of hope.

The Free Dictionary defines adrift as “floating without being either moored or steered.”Similarly, the Cambridge Dictionary also defines a person adrift as, “If a person is adrift, they do not have a clear purpose in life or know what they want to do.”Adrift in the context of my coaching style refers to an individual without purpose or the ability to reach their target. When one is adrift, there are a variety of emotions may arise, such as a feeling of stress, depression, fear, lostness, loneliness, purposelessness, exasperation, and directionless, just to name a few. None of these emotions or feelings empower the client, promote confidence, or provide a sense of hope.

Clients experiencing a feeling of being financially adrift will often also experience a sense or feeling of floundering. They are not where they would like to be financially, but for one reason or another, they are unable to arrive at the destination they desire. Typically, these individuals or families have unsuccessfully attempted to peruse or initiate plans of self-rescue.

Causes and Reasons for Being Financially Adrift

People feel adrift financially for a variety of reasons, some of the more common reasons are outlined below:

-

Prevailing National or Global Financial and Economic Conditions:

The current global economic and financial upheaval, exacerbated by Covid-19, the prevailing global supply chain issues, the conflict between Russia and Ukraine, and the resulting rising inflation rates, have all severely impacted household financial well-being. These unanticipated events have not only diminished the average household’s real income but also significantly increased household expenses and the cost of debt. The threat or likelihood of global economic recession could spur job losses as well as personal and business bankruptcies which in turn, increases stress and anxiety.

-

Unforeseen or Unanticipated Changes in Life’s Circumstances:

Unanticipated changes in life circumstances, loss of job, health challenges, family emergencies, etc., can adversely impact anyone’s financial security

-

Lack of Adequate Financial Literacy:

Financial literacy is generally defined as a specific set of skills, knowledge, and education that enable a person to make informed decisions with their financial resources as well as empower the individual to make good financial choices.

The benefit of being adequately finically literate includes allowing the individual or family to make informed financial decisions leading to improved financial and economic security and an overall sense of financial well-being.

-

Lack of an Effective Budget or Expense Plan:

A budget is simply one’s spending plan based on todays and future income and expenses. An effective budget helps build financial security by balancing income with spending and highlighting areas that can be adjusted in order to provide the client with financial security.

-

Lack of a Well-Thought-Out or Well-Crafted Overall Financial Plan:

The lack of a comprehensive financial plan that meets both the current and future goals and aspirations of a client can contribute to the client’s feeling of being financially adrift. The plan should consider savings towards other financial needs, such as children’s education, retirement, and planning for other life important milestones and emergencies.

-

Lack of Commitment or Adherence to a Budget/Financial Plan Once Made:

Unless one can adhere to their financial plan once made, the plan is of little use to the individual. Lack of commitment often derails the individual’s financial plan, and it becomes increasingly difficult for them to stay on the path to financial security.

-

Lack of Adequate Professional Help or Advice:

A lack of Professional financial advice or a coach to provide better insights as well as impartial and objective support can mitigate the feeling of being financially adrift. Professional help can improve the family or individual’s financial lives and security.

Secure

The Oxford dictionary defines secure as “fixed or fastened so as not to give way or become loose or be lost.” In essence, secure is being fastened. A financial anchor enables the individual or person to withstand life’s storms and feel secure. Clients who feel secure are more confident about where they are going and encourage to have more positive emotions. More importantly, security allows clients to have an idea of how to get to their destination.

The Oxford dictionary defines secure as “fixed or fastened so as not to give way or become loose or be lost.” In essence, secure is being fastened. A financial anchor enables the individual or person to withstand life’s storms and feel secure. Clients who feel secure are more confident about where they are going and encourage to have more positive emotions. More importantly, security allows clients to have an idea of how to get to their destination.

Being financially secure means that one is confident about their financial future and has the means and capacity to fulfill not only their current financial needs but also their future financial obligations. It also implies that they have the financial resources to meet their financial goals such as their children’s education, home ownership, family vacations, and secure retirement. They are then able to feel more confident that their family is on the right path to building or creating sustainable generational wealth.

Adrift vs. Secure: Affix Their Financial Anchor and Secure Their Financial Future

The only way you will ever permanently take control of your financial is to dig deep and fix the root problem– Suze Orman

My role as a personal finance coach is to help the client discover or uncover the reasons why they are stuck financially, and provide the support need to get them from a state of feeling adrift or a position of disempowerment to a secure state of empowerment. Thus, enabling them to affix their financial anchor and secure their financial future.

I target my coaching to the areas which my clients identify as “problem areas.” In my strategy, I emphasize financial literacy, budgeting, and overall financial planning to not only address any current concerns but to also ensure we consider their future needs as well. By leading the client through a self-discovery process, they not only uncover the sources of their “financial blockages,” but are also able to discover the benefits of being financially stable. In turn, they develop a better awareness of how to secure their financial future and identify what personal changes or lifestyle adjustments they need to make in order to ensure that the changes are sustainable and permanent.

Process

A good financial plan is a roadmap that shows us exactly how the choices we make today will affect our future– Alexa Von Tobel

First, the client needs to uncover or discover the reasons why they are financially adrift. A simple financial tool such as budgeting tools can highlight spending patterns that are creating the drift or money gaps.

Second, I support the client to create a new comprehensive plan that meets both the current and future goals and aspirations. The plan includes not only a budget but also includes provisions for an emergency fund to protect self and family from life’s endogenous and exogenous shocks. It also includes plans for investing in future needs such as retirement or children’s education.

Finally, when clients self-discover the reasons/causes of why they are financially adrift, the steps required to anchor their financial lives become clearer, and the commitment to stay on a course becomes much stronger. According to Statistics Canada, over 50% of all Canadian households across all income levels worry about their finances. Some of the financial challenges might be out of the individual or household’s control, but through effective coaching and financial planning, individuals are more equipped to prepare their household for whatever storm comes their way.

Questions for Reflection:

- Are you adrift financially?

- What is causing you to be adrift?

- What is the impact of the adrift on your personal life?

- What have you done in the past to mitigate your condition?

- What was the outcome?

- What practical steps can you take starting today on your journey to financial security?

- Who else can you rely on for support on your journey to financial security?

References

International Coach Academy

The Free Dictionary https://www.thefreedictionary.com

The Cambridge Dictionary https://dictionary.cambride.org/

Statistics Canada- The financial resilience and financial well-being of Canadians during the COVID-19 – September 2021: (By Kirk Donaldson, Jonathan Fonberg, Andrew Heisz, Jennifer Kaddatz, Julie Kaplan, Eric Olson, Ian Walker)